Forex Weekly Forecast & FX Analysis February 22 - 26

EUR/CHF

Last week, the value of the euro against the Swiss franc rose above the strong level of 1.0820, but this did not lead to a directed upward movement, since there is a clear lack of volatility in the currency pair. Nevertheless, the upward movement was minimal, and it reached the local maximum of the market. Taking into account the absence of obvious volatility, we can expect that the market will again fall to the level indicated above and after that it will go over the crust.

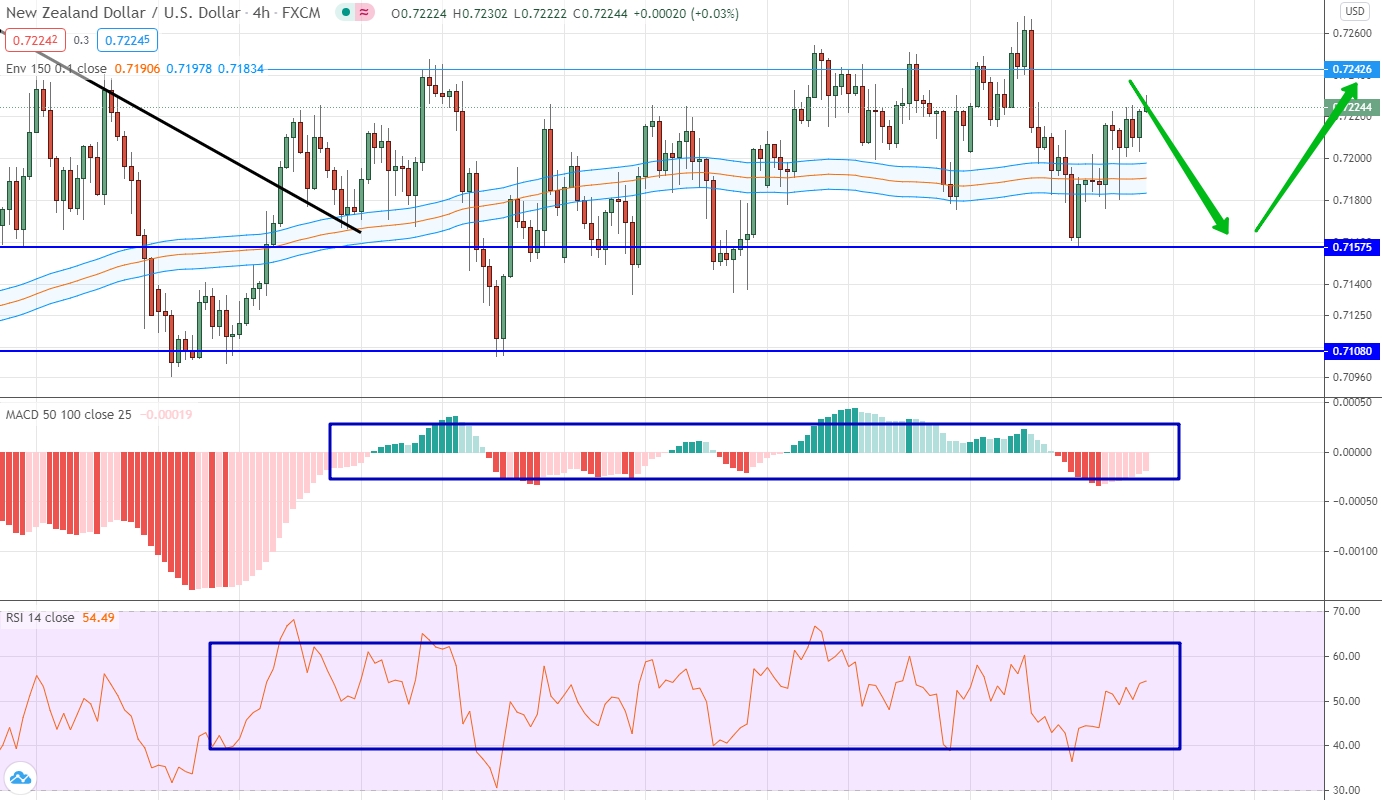

NZD/USD

For this currency pair, the most important characteristic is the absence of directional movement. This characteristic is very well traced for all indicators that are either close to neutral values or are minimally distant from them. Moreover, such development is not a specificity of one or two weeks, such dynamics has been confirmed for more than a month. Therefore, we can distinguish a side range with the boundaries of 0.7157 and 0.7242. As long as the price is within the range, we can trade from level to level.

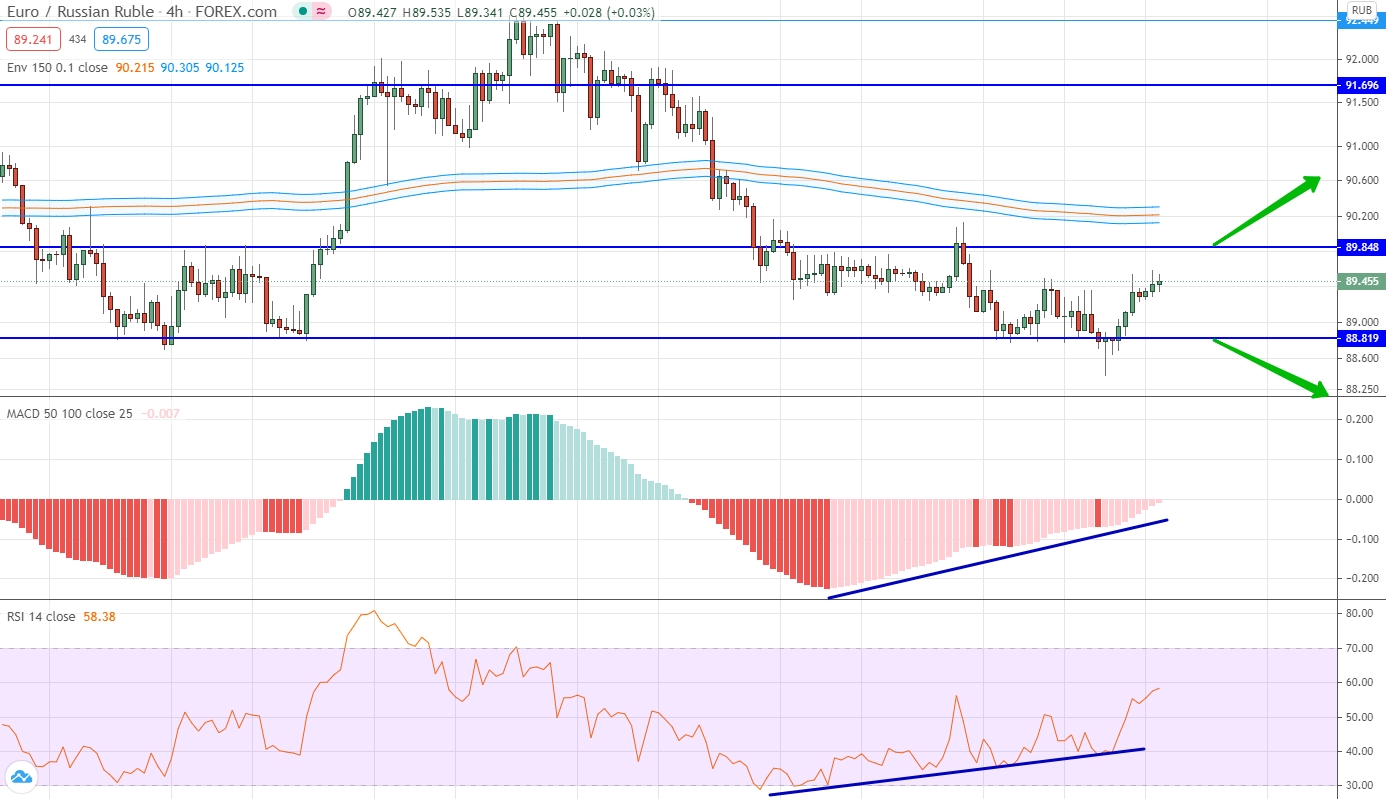

EUR/RUB

Trades last week significantly lowered the value of the euro against the Russian ruble, which made it possible to hold an additional important level for this currency pair at around 88.82. It is typical that if you look at the indicators, they have an upward slope, while the price looks down. Thus, we are talking about divergence, but this signal cannot be used in trading, since the price is framed in a rather narrow price range. The safest solution would be to wait in which direction this range will be broken and trade in the direction of the breakdown. An upward movement is most likely.

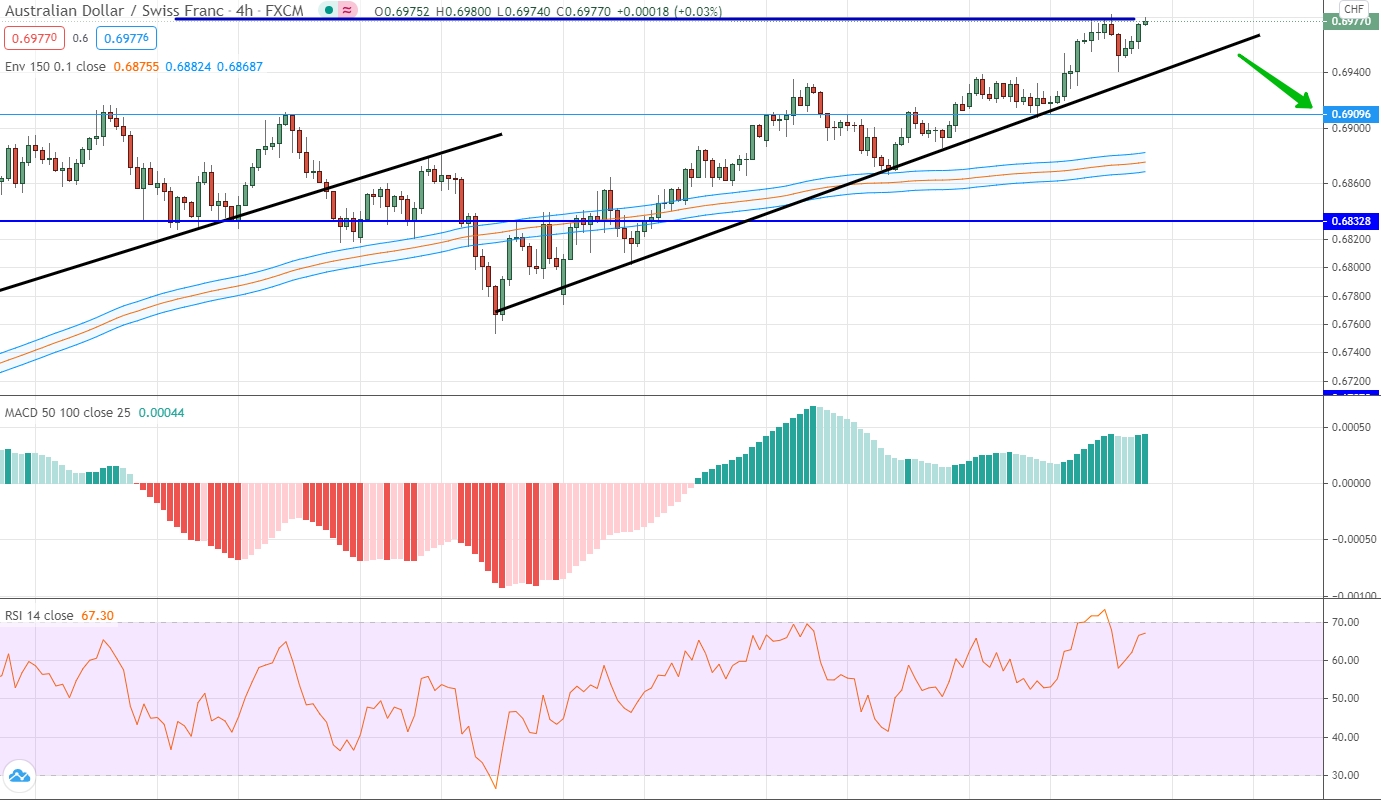

AUD/CHF

The Australian dollar continues to form an uptrend against the Swiss franc. Trades in recent weeks have only strengthened this trend, and as a result of the upward movement, the price turned out to be at its local maximum value. The upward dynamics is confirmed by all indicators, but they do not give clear signals for trading. We can only say that the strength of the upward dynamics is unconditional, but the market may need a correction, since it has grown very strongly in recent weeks. Therefore, you can consider trading options for a fall, but a trade can only be opened if the price is below the trend line.

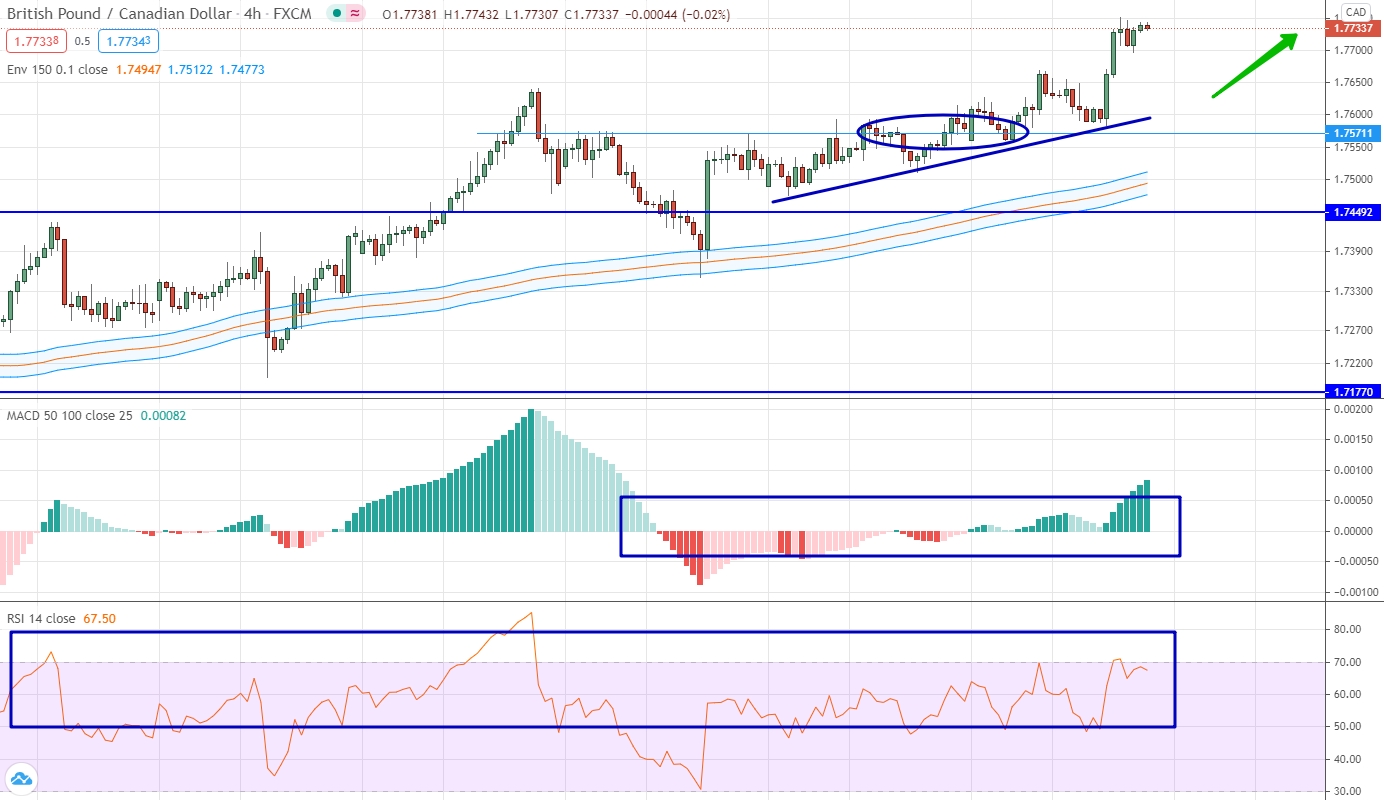

GBP/CAD

This currency pair is the next one within the current weekly review, where the upward dynamics prevails. This dominance is characterized by the fact that the market managed to gain a foothold above the level of 1.7571 and continued its upward movement. It is very important to note that the histogram confirms the upward trend and is close to neutral indicators, although it is trying to start growing. Oscillators confirm the upward trend, as they develop mainly in the area above 50. Therefore, you can continue to consider options for trading up, but a new deal can be opened only after a downward correction in the area of the trend line.

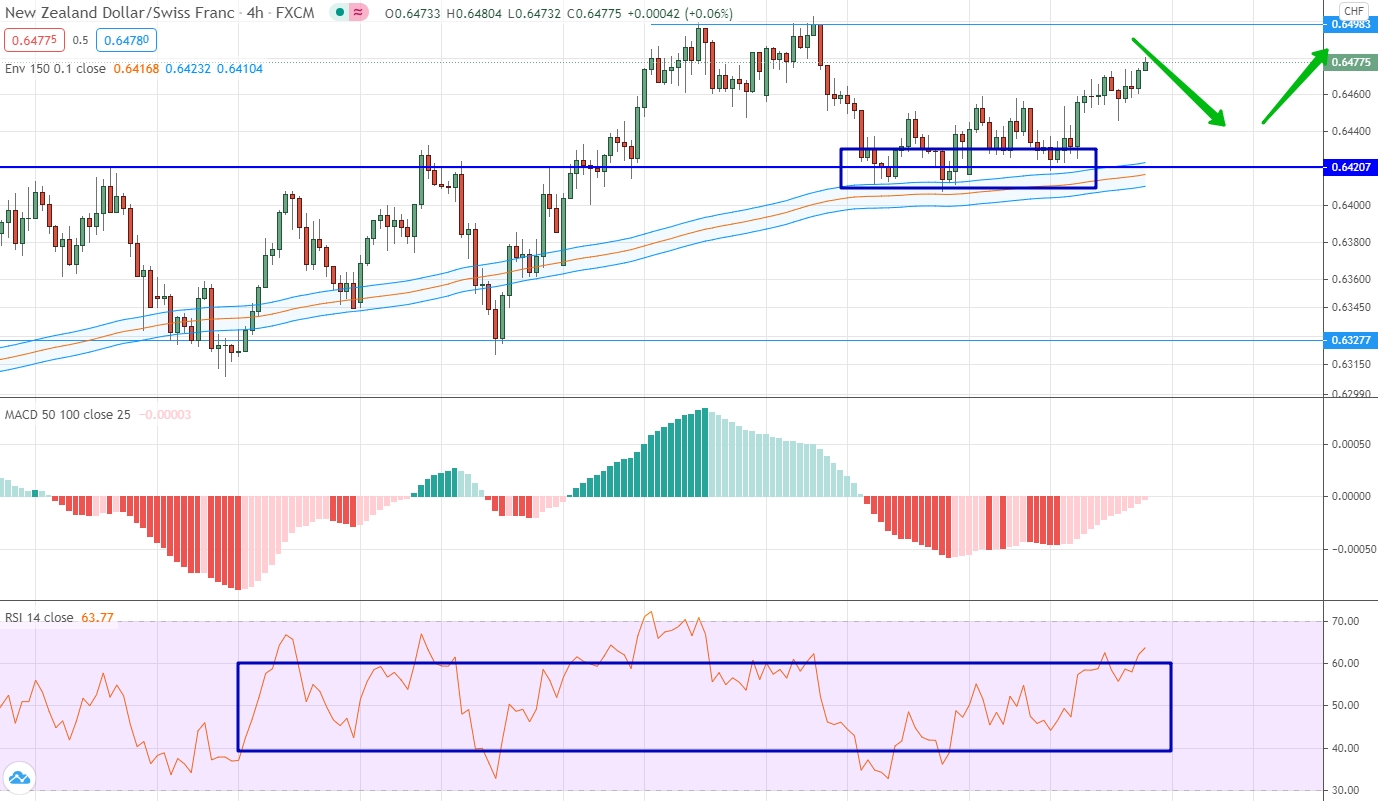

NZD/CHF

The value of the New Zealand dollar against the Swiss franc is framed by a fairly wide price range with the borders of 0.6420 and 0.6498. In fact, there is no trend movement now, and this characteristic of the market is confirmed by all indicators. First of all, this is clearly seen from the oscillator. Please note that a fairly strong correction and a strong reaction took place near the lower level, which in the current stage practically coincides with the moving average levels. Taking into account the current position of the price, we can say that while the price is within the designated range, you need to trade from level to level.

USD/CNH

Before the US dollar against the Chinese yuan, the main trend is still the downward movement. Please note that in the above chart we see at least 6 cases when the price tested the level of moving averages from bottom to top and immediately after that there was a pullback downward. At the same time, the downward movement has always been strong enough, and the levels of the moving averages themselves also have an unambiguous downward slope, although this slope becomes smaller over time. Nevertheless, we can expect that this time, after testing the moving averages, the price will go down, which means we are considering options for opening a downward contract.